Last week Innovation Lab Asia asked a number of Danish startups for their views on Asia as a market destination. Here’s what they answered…

Perhaps the most important take-away from the survey was this: Many Danish startups want to go to Asia, but they simply don’t know how to get there. Of the 80 respondents who answered the survey, 37 were planning for Asia on different levels, but only one (1) was actually active in Asia. 25 respondents had no Asia-plans.The main barriers were seen as lack of funds and funding opportunities (69%), and lack of knowledge of Asian markets (57%).

So basically Asia seems to be on the Danish startup radar, but the companies need access to investors and local stakeholders, who can screen Danish solutions in relation to local demands and help them navigate through the choppy waters of Asian reality. If not, they’ll most likely follow the well-trodden path of their peers, and head off to Europe and North America at most.

Where in Asia?

When asked about their preferred (or potential) Asian destination, Danish startups were overwhelmingly interested in China (49%). Coming in second were Japan (32%) and India (30%), followed by Singapore and South Korea at around 24%. Malaysia came in last of the seven listed destinations, with 8% interest.

Singapore was almost unanimously chosen as the go-to expansion area for startups responding from the fintech sector, while India was particularly popular with greentech and life science companies. Over 20% of respondents said they were not sure which Asian country they would expand to, reflecting a lack of knowledge about market opportunities in Asian countries.

What motivates?

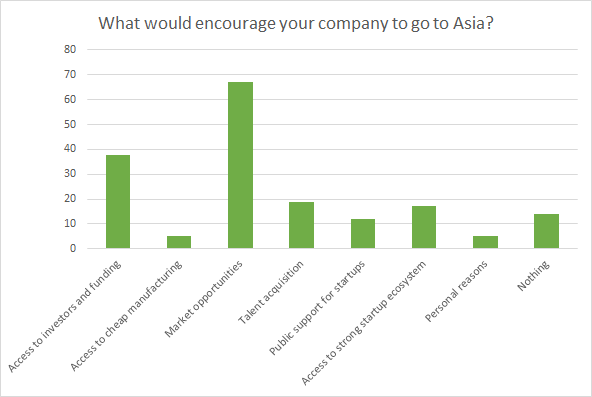

The two main drivers for Danish startups to expand into Asia were market opportunities and investor-access, the latter perhaps reflecting the diverse funding ecosystem in the region and a lack of opportunities for large funding rounds in Europe.

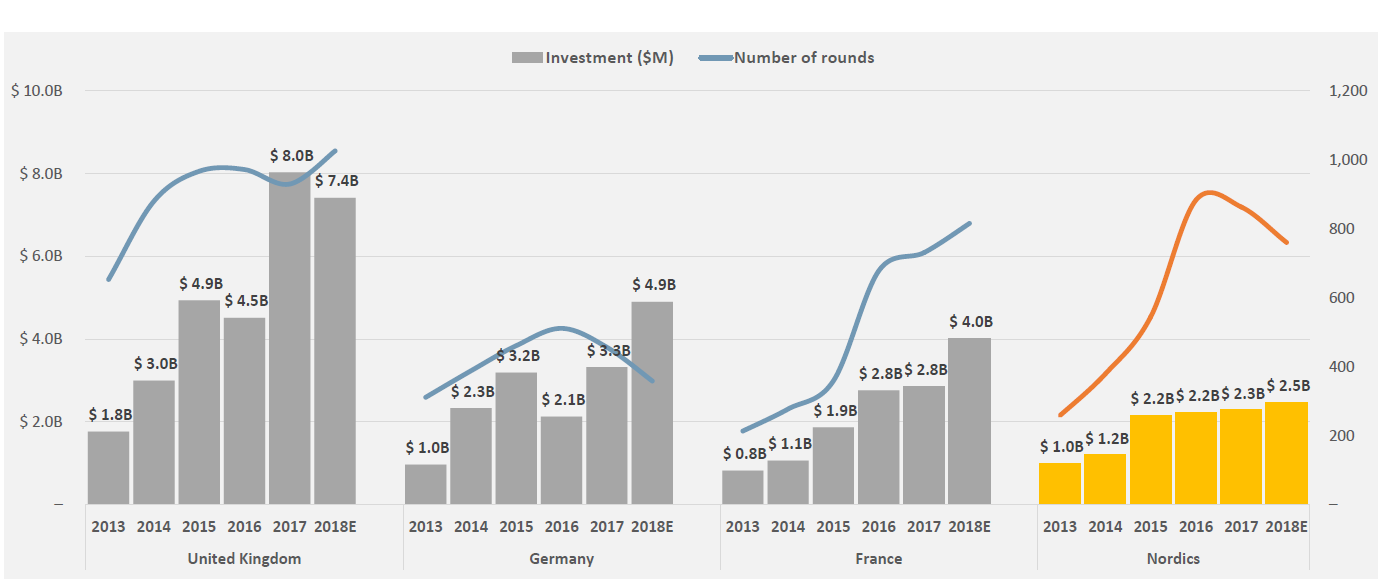

According to data presented at TechBBQ by Vækstfonden (Danish Growth Fund), Denmark lacks investment compared to neighbours Finland and Sweden, with both countries taking the lion’s share of VC activity. Additionally, in comparison to their European neighbors, Nordic startups raise smaller investment rounds.

Opportunities for talent acquisition was another driver for startup expansion into Asia (19%), although this begets the chicken-and-egg barrier that many Nordic startups face: they don’t have the right talent to expand into Asia, and acquiring that talent can best be done by expanding their network into Asia. Close to 15% said that they would not consider expanding to Asia regardless of the opportunities, with linguistic and cultural barriers, and fear of IP theft being the main reasons.

Opportunities for talent acquisition was another driver for startup expansion into Asia (19%), although this begets the chicken-and-egg barrier that many Nordic startups face: they don’t have the right talent to expand into Asia, and acquiring that talent can best be done by expanding their network into Asia. Close to 15% said that they would not consider expanding to Asia regardless of the opportunities, with linguistic and cultural barriers, and fear of IP theft being the main reasons.

What we do

It seems clear that Asia is perceived as a potential destination for Danish startups, if only market and funding opportunities were better described and more accessible. We need to know more about the Asian startup ecosystem, and we need to avoid being confused by its sheer size and complexity. We need to zero in on specific Danish opportunities, and focus on the 3-5 most interesting sectors/hubs per location, as seen from a Danish perspective.

Which hubs provide the best match for the Danish ecosystems based on Danish solutions and competencies? Where does Denmark have the strongest brand? Where do we find the strongest Danish expat communities to provide information and soft landing spots? Which hubs have the most accommodating institutions, stakeholders and other partners to work with from a Danish perspective. This is what we need to know, and this is what Innovation Lab Asia will provide.